Financial documents, such as invoices, receipts, contracts, and reports, are essential for various business processes and transactions. However, processing and analyzing financial documents manually is time-consuming, error-prone, and costly. Therefore, there is a need for automated methods to extract key information from financial documents and use them for various purposes, such as accounting, auditing, compliance, and decision making.

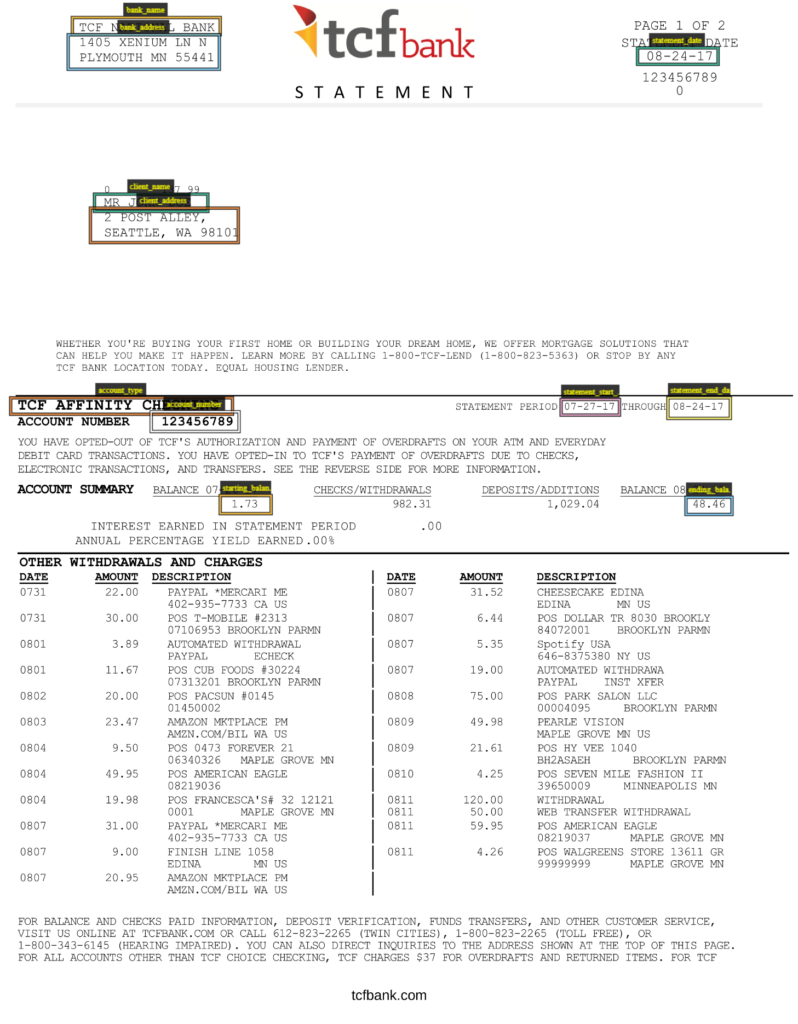

One of the challenges of financial document processing is that financial documents are often unstructured or semi-structured, meaning that they do not follow a fixed format or layout, and they may contain various types of information, such as text, tables, images, logos, signatures, and barcodes. Moreover, financial documents may vary in terms of language, style, quality, and complexity, depending on the source, domain, and context.

To address these challenges, machine learning algorithms can be used to perform financial document annotation and key information extraction. Financial document annotation is the process of adding labels or metadata to financial documents, such as identifying the document type, segmenting the document into regions or fields, and classifying the regions or fields into categories. Key information extraction is the process of extracting the relevant information from the annotated documents, such as the document date, invoice number, vendor name, total amount, line items, and payment terms.

Machine learning algorithms for financial document annotation and key information extraction can be broadly classified into two types: supervised and unsupervised. Supervised algorithms require labeled data for training and testing, while unsupervised algorithms do not require any labels and can learn from the data itself. Supervised algorithms can achieve higher accuracy and precision, but they also require more human effort and domain knowledge to create and maintain the labels. Unsupervised algorithms can handle more diverse and complex data, but they may also produce more noise and ambiguity.

Some of the common machine learning techniques used for financial document annotation and key information extraction are:

- Optical character recognition (OCR): OCR is a technique that converts scanned or printed images of text into editable and searchable text. OCR can be used to extract the text content from financial documents and prepare it for further analysis. OCR can be performed using deep neural networks, such as convolutional neural networks (CNNs) or recurrent neural networks (RNNs), or using traditional methods, such as template matching or feature extraction.

- Natural language processing (NLP): NLP is a technique that analyzes and understands natural language text. NLP can be used to perform various tasks on the extracted text, such as tokenization, lemmatization, part-of-speech tagging, named entity recognition, sentiment analysis, and topic modeling. NLP can help to identify and classify the key information from financial documents and extract the semantic meaning and context. NLP can be performed using deep neural networks, such as transformers or attention models, or using traditional methods, such as rule-based systems or statistical models.

- Computer vision (CV): CV is a technique that analyzes and understands visual information, such as images, graphics, or videos. CV can be used to perform various tasks on the financial documents, such as document segmentation, region detection, field extraction, table recognition, logo identification, signature verification, and barcode decoding. CV can help to locate and extract the key information from financial documents and capture the spatial and formatting information. CV can be performed using deep neural networks, such as CNNs or generative adversarial networks (GANs), or using traditional methods, such as edge detection or contour detection.

The following are some of the guidelines and best practices for financial document annotation and key information extraction using machine learning algorithms:

- Define the scope and purpose of the project: Before starting the project, it is important to clarify the objectives and expectations of the project. What kind of financial documents do you want to process and analyze? What are the use cases and applications of the annotated and extracted data? How will you measure the success and quality of the project? These questions can help you define the scope and purpose of the project and determine the appropriate machine learning techniques and tools.

- Choose the right machine learning techniques and tools: Depending on the scope and purpose of the project, you may need different types of machine learning techniques and tools. For example, if you want to extract the text content from financial documents, you may use an OCR system or a manual transcription service. If you want to identify and classify the key information from financial documents, you may use an NLP system or a manual annotation service. If you want to locate and extract the key information from financial documents, you may use a CV system or a manual extraction service. The choice of machine learning techniques and tools depends on the trade-off between speed, cost, and quality. You may also use a combination of machine learning techniques and tools to achieve the best results.

- Establish clear and consistent annotation and extraction guidelines: One of the most important factors for ensuring the quality and consistency of financial document annotation and key information extraction is to have clear and consistent guidelines. Annotation and extraction guidelines are a set of rules and instructions that define how to annotate and extract the financial documents, such as what labels or categories to use, how to handle ambiguous or unclear cases, how to resolve conflicts or disagreements, and how to document and report the project. Annotation and extraction guidelines should be specific, comprehensive, and easy to understand and follow. They should also be reviewed and updated regularly to reflect the feedback and changes in the project.

- Ensure the quality and reliability of the annotated and extracted data: After the project is completed, it is crucial to check the quality and reliability of the annotated and extracted data. This can be done by using various methods, such as cross-validation, inter-rater agreement, error analysis, and feedback. Cross-validation is a technique that splits the data into training and testing sets and evaluates the performance of the machine learning model on the testing set. Inter-rater agreement is a measure that quantifies the degree of consensus or consistency among different annotators or extractors. Error analysis is a technique that identifies and categorizes the types and sources of errors in the annotation and extraction. Feedback is a process that collects and incorporates the comments and suggestions from the clients and users to improve the quality and reliability of the data.

By following these guidelines and best practices, you can ensure that your financial document annotation and key information extraction project is successful and effective. Financial document annotation and key information extraction can help you unlock the potential of your financial data and use it to enhance your business performance and decision making.